Chinese Steelmaker Considers Canadian Iron-Ore Deal

Source: www.chinamining.org Citation: wsj.com Date: Sept.27, 2013

Wuhan Iron & Steel (Group) Corp. is in a thinning field of bidders for Rio Tinto PLC`s Canadian iron-ore assets, raising the possibility it would be the first Chinese state-owned firm to make a large Canadian acquisition since a controversial oil-sands deal last year.

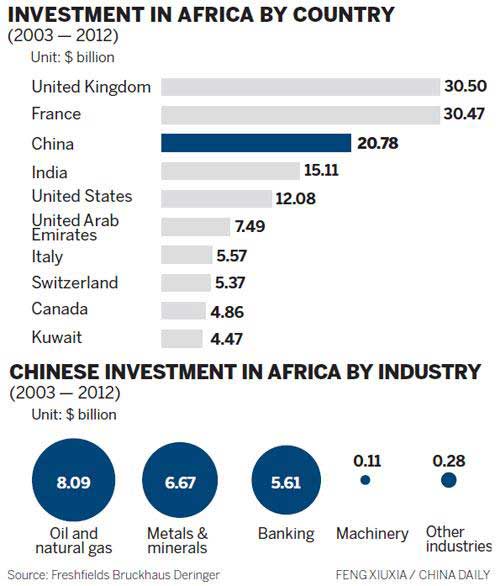

The Chinese steel giant is looking to buy, potentially with partners, the 59% stake in Iron Ore Co. of Canada that Rio Tinto put up for sale in March, according to people familiar with the matter. Wuhan`s interest underscores China`s continued appetite for metal assets, including iron ore, around the world.

In Canada, such a deal would be the first test of new rules Prime Minister Stephen Harper`s government applied to state-owned bidders in the wake of Cnooc Ltd.`s $15.1 billion takeover of Canadian oil-sands operator Nexen Inc. Though Canada approved the Cnooc-Nexen tie-up, it effectively blocked state-owned companies from acquiring oil-sands assets in the future, and signaled that attempts by state-owned firms to seek control of other Canadian assets would face higher scrutiny.

Earlier this year, analysts estimated that Rio Tinto`s stake in Iron Ore of Canada was worth around $4 billion, valuing the entire business at roughly $7 billion. Currently, any bid for a Canadian company, or a controlling stake in one, exceeding 344 million Canadian dollars ($333.6 million) has to be judged on whether it produces a "net benefit" to the Canadian economy. This year, Chinese companies have made a handful of investments below that threshold, but none above.

Some bankers say state-owned firms in China and elsewhere have been put off from bidding for Canadian assets by Ottawa`s tightened rules and by the furor that surrounded Cnooc`s acquisition and the roughly $5.2 billion acquisition of Progress Energy Resources Corp. by Malaysia`s Petroliam Nasional Bhd that occurred around the same time.

But there is Chinese interest in Rio Tinto`s Canadian iron-ore assets, people familiar with the matter say. China is the world`s largest steel-producing country and depends on imported ore for 60% of its steelmaking. Hebei Iron & Steel Co. mulled making a bid at one stage, according to people familiar with the matter. And China Minmetals Corp. said earlier this year that it was interested in bidding.

A representative for Hebei said they were unaware of any involvement in bidding. Minmetals didn`t respond to requests for comment. Representatives from Wuhan and Rio Tinto also declined to comment.

Though increasingly choosy, Chinese companies remain in the market for global metal assets, including iron ore. On Thursday, Tianjin Minerals and Equipment Group Corp. said it would pay $990 million for a 16.5% stake in a Sierra Leone iron-ore mine.

Rio Tinto`s Canadian iron-ore assets initially attracted wide interest, but many potential bidders dropped out of contention, saying the sellers were asking too high a price that, for instance, didn`t reflect the assets` complexity. Iron Ore Co. of Canada has two other owners and owns transport infrastructure, such as a rail line and port facilities.

Rio Tinto in June dropped plans to sell a different Canadian asset-a majority interest in a diamond mine-after that stake and the company`s other diamond properties failed to attract enough investor interest. Like other global miners, Rio Tinto has been trying to shed assets to shore up its finances during a slump in commodities prices and as investors demand greater returns.

Two of Canada`s largest pension funds, Canada Pension Plan Investment Board and Caisse de d¨¦pot et placement du Qu¨¦bec, were also at times mulling separate bids for the iron-ore assets, as were U.S. private-equity funds Blackstone Group LP and Apollo Global Management LLC. These funds have since dropped out, according to people familiar with the matter.

Canadian miner Teck Resources Ltd. has also shown interest, according to a person familiar with the matter. It is unclear where the Vancouver-based firm currently stands on bidding. The company-in which China Investment Corp, owns a 17% stake-declined to comment

About CHINA MINING

Since first held in 1999, the scope and influence of CHINA MINING has grown rapidly year by year. As a global mining summit forum and exhibition, CHINA MINING Congress and Expo has become one of the world’s top mining events, and one of the world’s largest mining exploration, development and trading platforms, covering all aspects of the whole mining industry chain, including geological survey, exploration and development, mining rights trading, mining investment and financing, smelting and processing, mining techniques and equipment, mining services, etc. playing an active promotion role in creating exchange opportunities and enhancing mutual cooperation between domestic and foreign mining enterprises.

CHINA MINING Congress and Expo 2013 will be held at Meijiang Convention and Exhibition Center in Tianjin on November 2-5, 2013. We invite you to join the event and to celebrate the 15th anniversary of CHINA MINING with us. For more information about CHINA MINING 2013, please visit: www.chinaminingtj.org.