Submersible taps vast mineral deposits in South China Sea

Source: www.chinamining.org Citation: China Daily Date: Jul.05, 2013

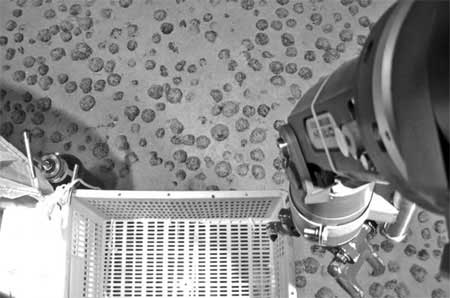

A robotic arm of Jiaolong readies to take a sample of the iron-manganese deposits on

A robotic arm of Jiaolong readies to take a sample of the iron-manganese deposits on

Wednesday that the deep-sea manned submersible first discovered during its ongoing

experimental voyage in the South China Sea.(Photo: Xinhua/China Daily

Jiaolong, the manned deep-sea submersible, is helping the country tap a treasure of iron-manganese deposits that were first discovered in the South China Sea on Wednesday.

Tang Jialing, an oceanaut on the submersible, told Xinhua News Agency that although the exact area of the deposits was still unknown, he was sure that it was large.

Tongji University Professor Zhou Huaiyang, who was on board Jiaolong`s support ship Xiangyanghong 09 on Wednesday, said scientists will conduct experiments to determine the age of the deposits.

"Since one of the samples was broken by the sub`s robotic arm, a round core inside could be identified as volcanic lava. The materials covering the core are iron and manganese oxides, which need tens of thousands of years to form," he said.

Li Xinzheng, a biologist who was on board the Jiaolong, told Science and Technology Daily that besides the excitement he felt when the large-scale deposits were discovered, he was also struck by the size of the deep-sea world and its expansive population of strange species, most of which he had never seen before.

"I will never forget my experience in the deep sea," Li said.

Jiaolong will carry out two more dives in the area to continue research and survey the seabed. The large underwater mountain where the deposits were discovered was named the "Jiaolong Seamount" by scientists on board the submersible, Xinhua reported.

Zhou said he hopes more rock samples will be collected from the seamount during the coming two dives.

Jiaolong completed four deep-sea dives from June 17 to 20, collecting rare animal specimens and mineral samples.

Jin Jiancai, secretary-general of the China Ocean Mineral Resources Research and Development Association, said Xiangyanghong 09 is expected to sail for 113 days and complete three dive missions in its first experimental voyage, which began on June 10.

The first mission, set to last about 43 days, is in the South China Sea, where Jiaolong will test its performance and scientists will study the formation and development of the waters and record its influence on China`s climate.

Jin added, the ship will then sail to two mining areas in the Pacific Ocean for a geological survey, collecting biological and mineral samples and preparing for future sea mining projects.

The mission marks the start of a five-year trial period for the Jiaolong before it starts regular operations, Xinhua reported.

Since 2001, China signed several contracts with the International Seabed Authority for mineral prospecting and exploration in the western Pacific Ocean and the Southwest India Ridge.

Jin told China Daily in a previous interview that the refined metals from the deposits will help the country meet the increasing demand for mineral resources during its rapid economic development.)

About CHINA MINING

Since first held in 1999, the scope and influence of CHINA MINING has grown rapidly year by year. As a global mining summit forum and exhibition, CHINA MINING Congress and Expo has become one of the world’s top mining events, and one of the world’s largest mining exploration, development and trading platforms, covering all aspects of the whole mining industry chain, including geological survey, exploration and development, mining rights trading, mining investment and financing, smelting and processing, mining techniques and equipment, mining services, etc. playing an active promotion role in creating exchange opportunities and enhancing mutual cooperation between domestic and foreign mining enterprises.

CHINA MINING Congress and Expo 2013 will be held at Meijiang Convention and Exhibition Center in Tianjin on November 2-5, 2013. We invite you to join the event and to celebrate the 15th anniversary of CHINA MINING with us. For more information about CHINA MINING 2013, please visit: www.chinaminingtj.org.