Coal prices set to stay low on mainland China for next 12 months

Source: www.chinamining.org Citation: www.scmp.com Date: August 18, 2014

|

| Mainland miners have been urged to cut their coal output. |

Mainland coal prices are expected to stay low for at least the next 12 months after a protracted slump, weighed down by weak demand, environmental constraints, domestic oversupply and rising imports.

While further downside is limited as leading domestic miners cut back on output to prevent prices from sinking to loss-making levels, according to some analysts, a meaningful recovery is some way off.

Analysts at ANZ last month slashed their forecast for this year`s average seaborne power-station coal by 4 per cent to US$74 a tonne, next year`s by 7 per cent to US$78 and that of 2016 by 11 per cent to US$82, saying "coal markets are awash with coal at a time of soft demand".

"But falling new mine investment [in Australia and Indonesia] should mean tighter supply and better prices in 2016 and 2017," it said in a research report.

The two nations account for most of the mainland`s coal imports, which, although accounting for only 9 per cent of consumption, has grown robustly in the past few years.

Australia has ramped up supply because some miners who committed to costly rail and port facilities built during the commodity boom in 2010 and 2011 are stuck with high payments, and were forced to keep raising output even with prices falling in order to spread the high fixed costs over high sales volume, ANZ said.

The bank said further price downside is limited since the current benchmark Australian coal price of around US$70 a tonne is not much higher than the US$60 a tonne break-even production cost of the mainland`s largest and most efficient coal miner Shenhua Group.

Prices at the mainland`s largest coal port Qinhuangdao have fallen just over 40 per cent since the downturn in coal prices began in late 2011, and have slid some 22 per cent so far this year.

Jefferies Securities analysts said in a research note they believe prices will not materially recover and have yet to bottom out, adding mainland coal demand has "more or less peaked".

Increasingly stringent environmental protection regulations mean highly polluting coal-fired power`s competitiveness over subsidised clean energy is slowly being eroded.

The latest tightening of emission standards took effect on July 1, forcing operators to spend more to remove pollutants or shut non-complying plants.

"As governments globally seek to reduce their carbon dioxide emissions, it looks increasingly likely that `king coal` will lose its crown," ratings agency Standard & Poor`s said in a report.

S&P projects the mainland`s coal demand growth to stay at low single-digit percentages before flattening by 2020.

Amid oversupply, the mainland`s coal output last year grew 1.4 per cent, or by 50 million tonnes - the lowest in more than a decade, according to data from the China National Coal Association.

In this year`s first half, output fell 1.8 per cent year on year. Still, net imports grew 1.5 per cent.

The industry`s first-half profit fell 44 per cent from a year before to 51.3 billion yuan (HK$64.48 billion). Of the 36 large miners tracked by the association, 20 were in the red, nine are close to breaking even and over half have cut or delayed paying salaries.

Prior to last year, domestic output expanded rapidly after mines were consolidated, and a transport bottleneck was gradually overcome with the completion of new railways.

The association`s head, Wang Xianzheng, last month called on miners to cut output by at least 10 per cent to restore the demand-supply balance.

The Shanghai Securities News quoted Wang Jinli, chairman of the sales unit of state-owned Shenhua, as saying the company has cut this year`s planned output by 11 per cent.

China Coal Energy, the listed unit of the mainland`s second-largest coal miner China National Coal Group, last week said it had cut its raw coal output target for this year by 10 per cent.

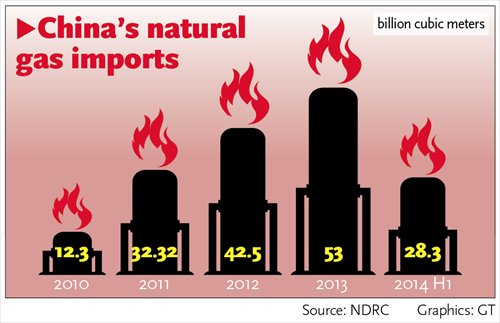

Given the success of United States energy firms in extracting natural gas trapped in shale rock formations, coal has lost significant market share to this supposedly cleaner energy.

If the mainland can emulate the American success, it could quicken coal`s replacement by shale.

"A significant decline in coal production and consumption globally is becoming a much more realistic concept," S&P said. "However, the pace and scale of change within the coal industry is far from clear, and investors could potentially remain in the dark for some time."

About CHINA MINING

Since first held in 1999, the scope and influence of CHINA MINING has grown rapidly year by year. As a global mining summit forum and exhibition, CHINA MINING Congress and Expo has become one of the world’s top mining events, and one of the world’s largest mining exploration, development and trading platforms, covering all aspects of the whole mining industry chain, including geological survey, exploration and development, mining rights trading, mining investment and financing, smelting and processing, mining techniques and equipment, mining services, etc. playing an active promotion role in creating exchange opportunities and enhancing mutual cooperation between domestic and foreign mining enterprises.

CHINA MINING Congress and Expo 2014 will be held at Meijiang Convention and Exhibition Center in Tianjin on November 20th-23rd, 2014. We invite you to join the event and to celebrate the 16th anniversary of CHINA MINING with us. For more information about CHINA MINING 2014, please visit: www.chinaminingtj.org.