Minmetals looking for $1bn nickel buy: Andrew Michelmore

Source: www.chinamining.org Citation: The Australian Date:Jan.07, 2013

After nearly a year bedding down the $1.3 billion acquisition of copper company Anvil Mining, Minmetals Resources chief Andrew Michelmore feels both his company and asset valuations are in the right place for another $1bn-plus base metals purchase.

And a quality nickel operation is sitting high on the wish list.

Mr Michelmore said MMG was now in a better position to pursue another big purchase after last year was spent dedicating resources to the integration of Congo copper play Anvil.

"Realistically you can probably only do one a year, and if we`d done another it would have stretched our people too much," he said.

Mr Michelmore plans to aggressively grow MMG, which in 2011 was outbid by Barrick Gold in a $7bn tussle for Equinox Mining that subsequently cost the Barrick boss his job, but said Anvil is probably about as small an acquisition as he wants to do.

"From a year ago, when expectations around prices were very high, the market has come back to where we would see things as more like reasonable value," he said.

The head of the Melbourne-based, Hong Kong-listed and Chinese-controlled miner said while there were certain countries MMG would not enter, the company was looking for base metals targets all over the globe, including in the Americas, Africa and Australia.

And while the nickel business is regarded as one of the tougher places to turn a profit in today`s mining sector, the former WMC Resources boss is keen to diversify production in that direction.

"We now have a good balance between zinc and copper, we like both those metals and we`d like to add a third wedge in there to have three good blocks of base metal commodities in our portfolio to get diversification," Mr Michelmore said.

When asked what base metals appealed, nickel was named.

"We like nickel sulphides, not nickel laterites -- there`s a lot of that around but we don`t have the expertise and it`s very expensive, capital wise," he said.

"But a good nickel sulphide is always going to be good."

Laterite mines, such as BHP Billiton`s Raventhorpe operation in WA that was sold to First Quantum for a fraction of its $2bn development cost, require extensive processing of ore at high temperatures and pressures and have a history of going awry.

To date, MMG`s nickel designs have been limited to exploration programs it has embarked on in Africa, Canada and the US.

Despite the desire to get into nickel, there are no plans to start the mothballed Avebury nickel mine in Tasmania that was closed in 2008.

An informal sale process for the mine has been ongoing, with no buyers to date, and Avebury, which was planning to produce 8500 tonnes a year of nickel, is too small compared with the assets MMG wants to operate.

MMG`s interest in getting further into nickel comes as BHP is under increasing pressure to sell the West Australian nickel business it bought in 2004 when it acquired Mr Michelmore`s WMC.

MMG is targeting assets that are yet to start production or have recently started, meaning the long-running BHP nickel assets have little chance of coming back under the control of Mr Michelmore.

Mr Michelmore has not been surprised by the apparent strengthening in China, which last year he predicted would happen after the leadership change.

"I think the Western world is starting to realise China hasn`t fallen in a hole -- for me, I`m thinking `what`s taken you so long?`."

Mr Michelmore is also tipping a recovery in the US this year.

"I think as the confidence picks up in the US, US investors will pull their money out of Australia, out of equities; that will dump the Australian dollar," he said.

"It will be interesting to see whether it dumps the stockmarket as well.

"I think we`ve been living on the hog for too long with an unreasonably high exchange rate and high labour costs and I think when it turns we`re going to find it pretty difficult."

About CHINA MINING

Since first held in 1999, the scope and influence of CHINA MINING has grown rapidly year by year. As a global mining summit forum and exhibition, CHINA MINING Congress and Expo has become one of the world’s top mining events, and one of the world’s largest mining exploration, development and trading platforms, covering all aspects of the whole mining industry chain, including geological survey, exploration and development, mining rights trading, mining investment and financing, smelting and processing, mining techniques and equipment, mining services, etc. playing an active promotion role in creating exchange opportunities and enhancing mutual cooperation between domestic and foreign mining enterprises.

CHINA MINING Congress and Expo 2013 will be held at Meijiang Convention and Exhibition Center in Tianjin on November 2-5, 2013. We invite you to join the event and to celebrate the 15th anniversary of CHINA MINING with us. For more information about CHINA MINING 2013, please visit: www.chinaminingtj.org.

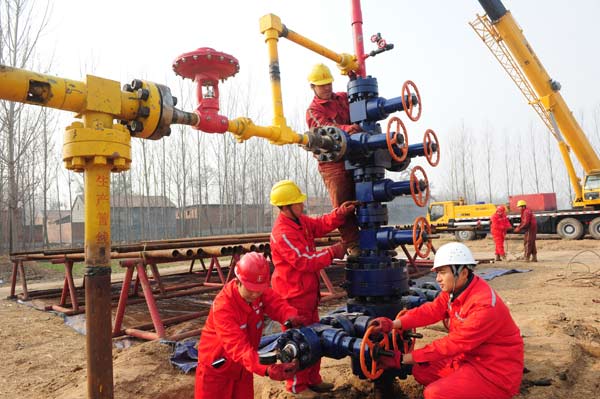

[Tong Jiang / China Daily]A natural gas production plant in Puyang, Henan province. According to the latest figures from the Ministry of Land and Resources, China has 134.42 trillion cubic meters of shale gas in its reserves.

[Tong Jiang / China Daily]A natural gas production plant in Puyang, Henan province. According to the latest figures from the Ministry of Land and Resources, China has 134.42 trillion cubic meters of shale gas in its reserves.