Mining for deals in London

Source: www.chinamining.org Citation: China Daily Africa Date: February 13, 2015

The road to mineral resources from Africa passes through UK as Chinese firms look for value in London-listed companies

China`s search for minerals in Africa is increasingly extending to companies listed on the London Stock Exchange.

While deals in general have fallen off in the past year or two, the trend is clearly toward more Chinese involvement. This is due to London`s heavy concentration of mining analysts and listed mining companies, experts say.

|

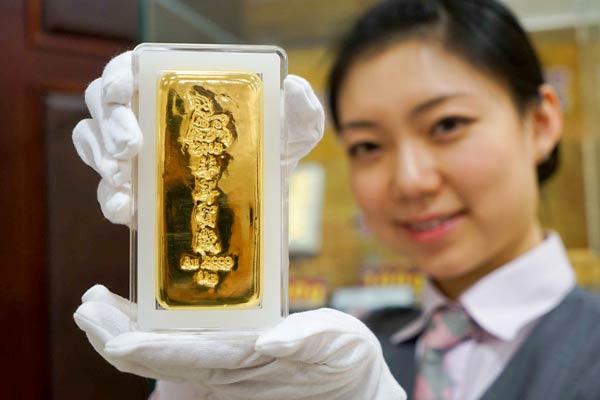

| Stock prices for resource companies are low and Chinese investors see this as an opportunity to buy in. Provided to China Daily |

The key advantage of buying London-listed African resource firms is easy access to information about these firms, and the good corporate governance and transparency these firms have, they say.

In recent years, a handful of Chinese bids for London-listed mining stocks have been successful, ranging from Xiamen Zijin Tongguan Investment Development Co Ltd buying Monterrico Metals plc in 2007 to China Guangdong Nuclear Power Holding Corp buying Kalahari Minerals plc in 2013.

Monterrico, which owned several base metal projects in Peru, and Kalahari, which had a uranium mine in Namibia, are representative of most mining stocks in London, which have physical assets outside Britain.

They are drawn to the London Stock Exchange because the concentration of mining analysts there can help to better explain their business models to investors, leading to improved financing terms.

This is particularly true for cash-hungry, smaller mining companies, typically listed on the LSE`s Alternative Investment Market. Last month, 132 of the 1,104 stocks on AIM were in mining.

Adam Hastings, a partner at the law firm Squire Patton Boggs, says it is common for investors to buy strategic stakes in London-listed African resource firms, and Chinese companies are increasingly joining this trend.

"Having a London listing gives companies better exposure to resource-sector investors and analysts, which is why many resource firms actively seek London listing when they wish to raise capital," Hastings says.

"Currently, stock prices for resource companies are generally quite low as a result of falling commodity prices, broader investor pessimism and other market issues, and these prices often do not reflect the value of the underlying assets. Chinese investors, who typically take a longer-term approach to their investment, will often see this as an opportunity to acquire a significant interest in the business at a discount to its actual value."

Hastings says the initial stake for most such investors, including Chinese ones, would be no more than 30 percent as a result of legal and regulatory constraints, and particularly the UK Takeover Code mandatory offer requirements.

However, in a listed company where the shareholder base is so spread out, having a 20-30 percent share would very often make the investor the biggest shareholder, Hastings says, and in any event it would give the investor significant control over decisions requiring shareholder approval.

That initial investment can provide a platform for increasing the investor`s interest over time through provision of further funding, he says.

"Resource companies are capital intensive, and will usually approach their biggest shareholders first when looking to raise additional capital.

"Chinese investors have typically shown a willingness to put more money into the business where other investors with a shorter-term view may not, which indirectly increases their percentage holding in the company," Hastings says.

That investment at the listed company level can also give Chinese investors the level of involvement in management of the business that they usually like.

"In these situations, buying a minority stake in the listed entity, which often come with a seat on the board and rights to interact with management, can provide them with the desired level of involvement," he says.

John Battersby, a consultant to Brand South Africa, a government agency, says having a London listing is an important channel for African resource firms to acquire capital, so African ministers frequently travel to London to give their companies support.

"The African ministers want their economies to grow, so they come to London to meet investors, to answer questions about Africa`s political and social situation, and reassure them of the good opportunities to invest in Africa," Battersby says.

He says he has witnessed a growing trend of Chinese investors going both to London to research listed resource companies and going directly to Africa to search for private companies.

Generally, African-based resource firms that have an overseas listing will be more mature, because overseas stock markets have strict listing requirements on a company`s stage of growth, he says.

For example, when mining companies initially grow, they have to determine whether there are resources available for extraction. Then, a feasible extraction plan has to be formed, and the cost-return balance of doing the project has to be evaluated.

"All these factors make mining projects risky at early stages, but listed companies are generally at a later stage of growth and hence they are less risky," Battersby says.

David Avery-Gee, a partner in the London law firm Linklaters LLP, says a London listing will allow the African resource company to have more transparency.

At Linklaters, Avery-Gee`s team has helped many resources-based companies with assets in Africa to seek listings on the London Stock Exchange. Premium listings, which are a special type of listing on the exchange`s main board, are particularly helpful in backing up a company`s credibility, he says.

"People can be confident that if you are investing in a company which is premium-listed in London, it`s almost like having a seal of approval; it is certainly the gold standard of listing," Avery-Gee says.

This is because the due diligence and corporate governance required for a London listing is high, so investors can be confident in the accuracy and completeness of the mining company`s disclosure. In addition, having the London listing itself also allows companies to grow, with the ability to access new capital.

The peak of mining asset prices occurred around 2012-13, when China`s rapid growth and development fueled great demand for natural resources, but this has slowed down more recently.

"There are still deals being done, but not on the huge scale we saw before, over the previous couple of years. With the falling commodity prices, the deals have slowed down also," Avery-Gee says.

Giles Distin, a partner at Squire Patton Boggs law firm, also says that merger and acquisition activities on the London Stock Exchange are currently low, but this could change as commodity prices continue to come under pressure and UK-listed natural resources companies are forced into transactions to stay afloat.

Distin says that under current conditions, Chinese bidders have also been less active in the UK in relation to possible takeovers in natural resources. The ultimately fruitless discussions about acquisition of, or further investment in, Bellzone Mining plc by China Sonangol International (S) Pte Ltd constitute a rare example of such activity.

China Sonangol International, which is a major shareholder of Bellzone, was in discussions about a potential takeover of Bellzone last March, but decided otherwise.

Distin says Chinese companies still have concerns when acquiring public targets, including financial and other information disclosures required by takeover rules, and the need to deal with the publicity of potentially failing in a bid, Distin says.

"For takeovers of UK companies, the bidder is required by the UK Takeover Code to disclose information on itself and sometimes its owners, which some Chinese companies may not feel comfortable with if they`ve never had to disclose that sort of information before."

Another concern of Chinese investors in trying to buy a public company is that the bid may fail, as often one bid attracts a higher bid from another investor.

One such case is the failure of Minmetals of China to buy Equinox Minerals in 2012, after attracting a counter bid from Barrick Gold of Canada of 7.2 billion Canadian dollars ($7.2 billion), 16 percent higher than Minmetals` bid. Equinox, which owns assets in Zambia and Saudi Arabia, was listed in Australia and Canada.

"There is a risk that you will not win," Distin says. "You go out publicly with your offer, you`ve put your head above the parapet, and then you fail."

Majority shareholders` consent is usually much harder to obtain in public deals because of a more diversified share structure, he says.

"Acquirers may prefer to have a deal where you sign some legal documents with the key shareholders and then it`s done. But a publicly traded company may have thousands of shareholders, and you can`t go to all of them to secure consent prior to the offer."

About CHINA MINING

Since first held in 1999, the scope and influence of CHINA MINING has grown rapidly year by year. As a global mining summit forum and exhibition, CHINA MINING Congress and Expo has become one of the world’s top mining events, and one of the world’s largest mining exploration, development and trading platforms, covering all aspects of the whole mining industry chain, including geological survey, exploration and development, mining rights trading, mining investment and financing, smelting and processing, mining techniques and equipment, mining services, etc. playing an active promotion role in creating exchange opportunities and enhancing mutual cooperation between domestic and foreign mining enterprises.

CHINA MINING Congress and Expo 2015 will be held at Meijiang Convention and Exhibition Center in Tianjin on November 20th-23rd, 2015. We invite you to join the event and to celebrate the 17th anniversary of CHINA MINING with us. For more information about CHINA MINING 2015, please visit: www.chinaminingtj.org.