Global mining sector on the way up, but recovery still slow

Source: www.chinamining.org Citation: www.mining.com Date: July 30, 2014

Global mining activity showed steady signs of improvement in the first half of the year, but recover is still expected to be slow, the latest study by SNL Metals Economics Group published Tuesday shows.

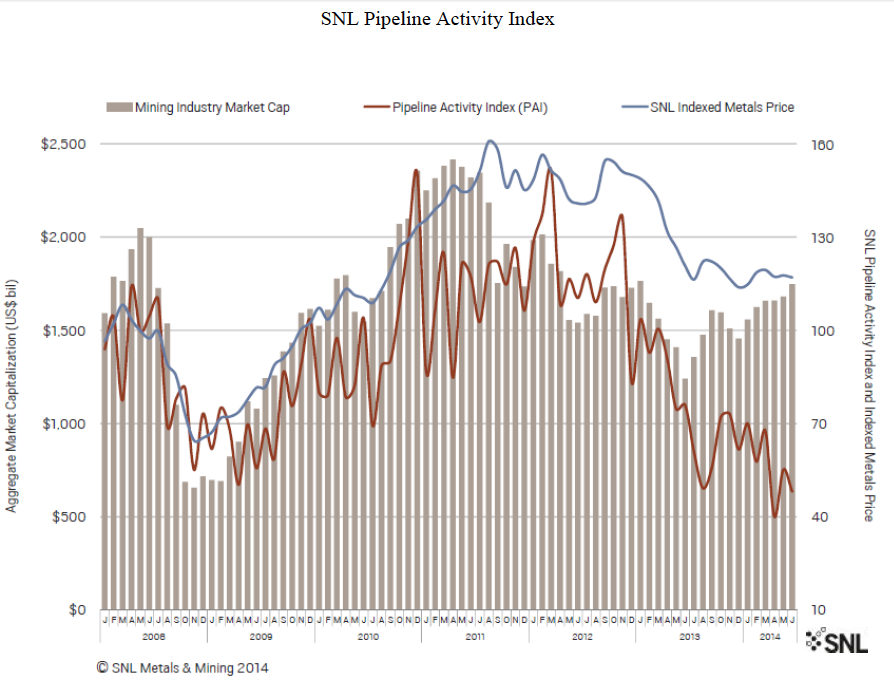

Its closely watched Pipeline Activity Index (PAI)- one of the most trusted indicators of the global exploration sector`s overall health - recovered a bit in May after an all-time low in April, but still sits at low levels, SNL notes.

The good news, said the Charlottesville, Virginia-based research firm, is that the industry`s aggregate market capitalization improved for the sixth month in a row in June, reaching $1.75 trillion. This is a 20% increase over December 2013 and the highest level since January 2013.

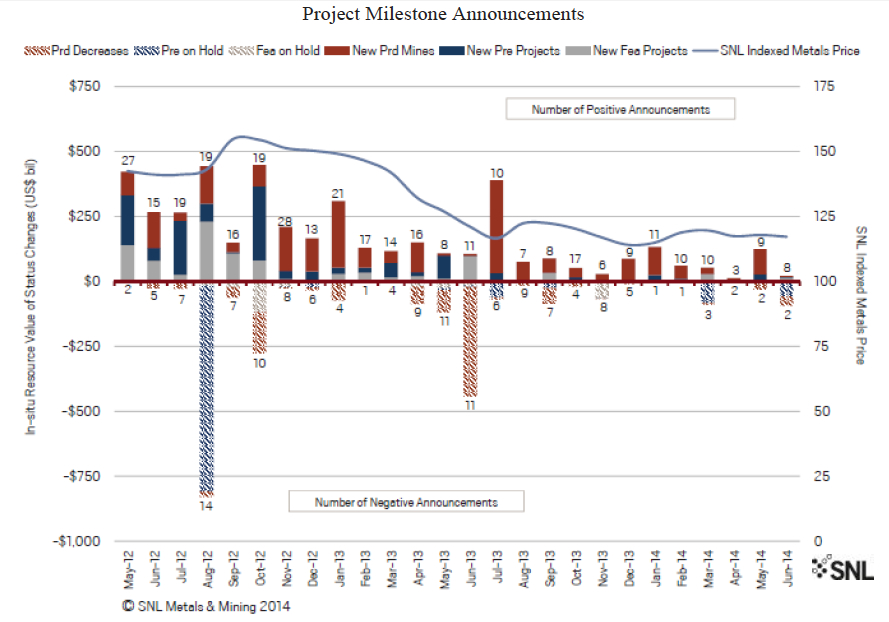

The recovery was driven mainly by a high number of encouraging milestones, including several new mines coming on stream.

The number and value of positive announcements, shows the study, increased significantly in May-June from the lows seen in the first four months of 2014. The in-situ value of advancing gold reports was considerably higher than in the March-April period, including production starting at several mines.

|

|

The largest positive announcement was from Newcrest Mining`s Cadia East gold mine in New South Wales, which was officially opened in May. At full capacity, Cadia East will produce 250,000 oz/y of gold and 15,000 mt/y of copper.

The leading negative news came from First Quantum`s Kansanshi copper mine in Zambia, where the company will reportedly slow or postpone additional spending on an in-progress expansion due to uncertainty over the country`s fiscal regime.

About CHINA MINING

Since first held in 1999, the scope and influence of CHINA MINING has grown rapidly year by year. As a global mining summit forum and exhibition, CHINA MINING Congress and Expo has become one of the world’s top mining events, and one of the world’s largest mining exploration, development and trading platforms, covering all aspects of the whole mining industry chain, including geological survey, exploration and development, mining rights trading, mining investment and financing, smelting and processing, mining techniques and equipment, mining services, etc. playing an active promotion role in creating exchange opportunities and enhancing mutual cooperation between domestic and foreign mining enterprises.

CHINA MINING Congress and Expo 2014 will be held at Meijiang Convention and Exhibition Center in Tianjin on November 20th-23rd, 2014. We invite you to join the event and to celebrate the 16th anniversary of CHINA MINING with us. For more information about CHINA MINING 2014, please visit: www.chinaminingtj.org.