Mr. Si Xinbo delivered a speech on the keynote session of CHINA MINING 2015

|

| (photo from Zhao Xinhao, edited by Xu Xiaojing) |

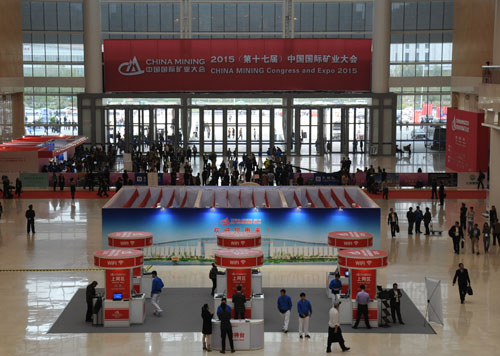

| On the morning of October 21, 2015, the keynote session of CHINA MINING Congress and Expo 2015 was held at Meijiang Convention and Exhibition Centre of Tianjin. Leaders of the industry and renowned economists gave speeches centering on New Normal, New Opportunities, New Development. This was a scene that Mr. Si Xinbo, Deputy General Manager of Silk Road Fund, delivered a speech with the topic “Play role of Silk Road, promote international mining investment cooperation on the premise of mutual benefit and shared profit”. |

Respected Guests, Friends,

Ladies and Gentlemen,

Good morning!

I was very honored to attend the 17th CHINA MINING and gathered together with officials from different countries, experts, scholars, and colleagues in Tianjin, discussing cooperation and development of international mining industry. To take this opportunity, I believed that we could share penetrating opinions and found high-quality partnership and development chances.

Today, my topic was “Play role of Silk Road, promote international mining investment cooperation on the premise of mutual benefit and shared profit”. There were four parts of my speech.

First, it was about current situations of mining industry.

In the process of profound adjustment of the global economy, mining industry faced various difficulties and challenges. It was proved by historical experience that the distribution and the way of development of mining had close relationship with the global economic structure. Changes of international economic situation also affected the mining industry greatly. After the financial crisis in 2008, global economic recovery was slow than expected with obvious regional differences. In the second season of this year, the United States as a major power of economic growth enjoyed 3.7% of GDP growth rate. China also maintained 7% of high growth rate in the first half of year.The Eurozone, with the help of European Central Bank’s plan of purchasing debt and plan of investment, gained support from many sides except Germany and France. Benefited from the decrease of oil price and capital cost, Japan, India and Southeast Asian countries enjoyed positive increase signals. The increase of African’s foreign investment also remained at over 80%. But at the same time, some countries were digesting subsequent impacts of heavy debt and high unemployment. Some countries suffered from aging population and slowdown of production growth rate. The economy of Eurozone was still weak and the economic growth rate of emerging countries in Asia, Latin America and CIS was decreased. Geopolitical conflicts, natural disasters, and incidents also added uncertainties. Potential growth factors and market risks intertwined, which remained a slow growth of global economy in the process of profound adjustment. The development of mining industry, therefore, faced insufficient demand, financing obstacles, and profitability dilemma.

Let us focus on China. By the first half of this year, China enjoyed a three-month recovery in industrial added value. In April, the social electricity consumption experienced continual increase from negative to positive. Total retail sales of social consumer goods and new-type consumption grew rapidly. Sales of housing was clearly improved, employment was stable, and urban and rural residents’ income enjoyed faster increase than GDP. In the meantime, domestic infrastructure construction had little effect on steady growth. Export was subject to the global market with insufficient demand. Deflation should not be neglected. Financial increase and payoff improvement faced challenges, and the economic pressure was still great.

In the past decade, emerging market economies, including China, injected great power to the world economy through their rapid economic growth. It generated huge demand which could become a vital driving force for the prosperity of the mining industry. However, currently Chinese economy was in a crucial period of time of growth mode transformation. With constant structural optimization, the growth rate went down. Demands from emerging countries had little effect on the mining industry. Because of profound structural adjustment, traditional motive power was declined and new motive power did not emerge. Demand structure, industrial chain, trade and investment conditions encountered new changes and difficulties.

Second, it was about features of mining development.

Although the mining industry would continue depression, it still showed several features in the profound adjustment.

First of all, the depression of mining industry continued with few signs of a pick-up. The global economy experienced slow growth and oil price gradually went down to the lowest point of a five-year record. Low oil price triggered a downward turn of bulk commodity price, which led to the most austere situation of financial crisis with continual declination. SNL metal price index went down from 107 point in March to 103 point in late June. The amount of global prospecting projects decreased from 418 in April 2014 to 380 in this first season and 363 in the second respectively. PAI was 44.3 in this June, reaching the lowest point 40.2 in April. Consumption increase of global mining resources was obviously slowed down. Supply of mining materials and products became surplus, and mining products, capital, and stocks faced common price crisis. In short run, there was no favorable turn for full mining industry to overcome depression.

Secondly, mining prospecting expanded from traditional mining countries to developing countries and blank areas with rich resources. Prospecting was a process of continual search and finding. Depressed mining industry brought price and cost pressure. Traditional mining countries, such as Canada and Australia, attracted fewer investment, and the hot point of prospecting gradually transferred to some resource-abundant developing countries in Latin America and Africa. For example, Canada became the top ten choices for mining negotiation and discussion in 2014. At the same time, prospecting in deep see areas, high altitude areas and polar regions grabbed more attention and proposed higher requirement to capital, technology, equipment, and the whole chain coordination. The expansion of mining prospecting offered foundation and confidence for the recovery. With gradual improvement of global economic situation and integration of mining industry, the comprehensive performance of this industry would be improved in two or three years.

Thirdly, with increasingly strict social responsibility and environment protection standards, technical threshold and cost pressure of mining investment and cooperation were lifted. Traditional mining work method usually accompanied with environment problems, however, transformation of economic growth mode and adjustment all required changes of mining resource development and utilization. It meant that higher technical threshold and greater cost of mining industry would boost survival of the fittest according to returns and efficiency and project integration. In terms of project investment, major transnational banks and investment organizations would generate some common standards that were specialized in social responsibility and environment protection. Future mining development asked for attention on social responsibility and environment protection. Relevant investment and cooperation should attach importance to them under the framework of return and risk analysis.

Fourthly, depressed industry and loose administration led to dynamic merger and restructure in the field of mining. Austere market situation gave burdens to the mining industry and generated more restructure chances for mining companies. Asset acquisition and re-organization were the major measures for large international mining corporations to optimize capital structure, increase operation quality, and decrease risk. According to SNL surveys, in the first season of this year, there were 23 mergers and 35 mergers in the second season. The merger amount in the first season related to metal was 2.93 billion dollars and doubled to 6.5 billion dollars in the second season. Some mining countries, in order to stop the downward economic trend and increase their competitive power, revised their mining laws, adjusted taxation, speeded up examination and approval, improved investment environment, and presented new trends of loose administration. Changes of market environment and policy background brought new opportunities and space for resource optimal allocation and investment.

Third, it was about the Silk Road Fund.

Adjusting to the economic growth mode transformation in China and the globe community, the Silk Road Fund came into being to realize mutual development and benefit in countries participated in the One Belt and One Road initiative.

Guests and friends, the situation of global economic growth was not optimistic. Many industries, including mining industry, did not lift themselves from pressure. Countries should coordinate and cooperate in trade, investment and finance so as to overcome difficulties and obtain mutual development, without exception, China should do so. Silk Road Fund was established under the circumstances of the One Belt and One Road initiative as well as the trend of economic growth mode transformation and cooperation structure escalation. I was honored to introduce Silk Road Fund to you and I hoped that it could generate more choices for mining cooperation.

Firstly, I would like to introduce the orientation of Silk Road Fund. On November 8, 2014, President Xi Jinping announced at Strengthening Interconnection and Partnership Dialogue of APEC that China would contribute 40 billion dollars to establishing Silk Road Fund. It was a medium and long term fund founded for supporting the initiative. According to marketization, globalization, and professionalization, it promoted investment and cooperation in terms of infrastructure construction, resource development and industrial cooperation of related countries and regions through equity investment and many other methods. It boosted mutual prosperity and development, realized reasonable returns, and achieved long-term financial operation.

Therefore, Silk Road Fund had following features.

a. Serving the construction of One Belt and One Road, it promoted balanced new-type partnership among countries, brought about mutual benefit, provided financial support and platform for extensive cooperation in relevant fields, and tamped the foundation of long-term economic growth and steady development.

b. As a medium and long term investment fund, it gave financial support to projects that had long periods and modest returns, including infrastructure construction, energy and resources, industrial and financial cooperation, instead of seeking short-term profit.

c. Taking equity investment as a major method, it supported companies to have deep involvement by acting as shareholders rather than joining EPC project contracting only. It strengthened the control of projects and improved management in order to realize international management.

d. It was flexible to provide financial support in equity which was beneficial to the best choice of financial organization according to project features and trade structures.

e. adhering to market operation, it was neither an aid fund nor a policy fund. It stuck to market principles and requirement, maintained sustainability, and carried its historical mission.

Secondly, I would like to introduce the investment idea of Silk Road Fund.

a. Investment and operation of Silk Road Fund insisted in principles of dialogue and planning with countries. The initiative of One Belt and One Road followed peaceful cooperation, inclusiveness, mutual learning and construction. It was against close and exclusive cooperation. Presently, the European Union proposed a 315-billion-euro Juncker Plan, Russia proposed that the Far East Area should be developed first, and Kazakhstan put forward the Road to Light Plan and maritime power strategy. Pakistan proposed Vision 2025 Development Plan. Many countries were searching for plans to improve international economic coordination and cooperation.

Investment of the fund aimed at docking with present cooperation mechanisms and development plans of related countries and regions, giving consideration to their degree of comfort, and binging about mutual prosperity through Pareto Improvement.

b. Investment and operation of Silk Road Fund insisted in principles of realizing reasonable medium and long term returns. It was founded in light with share-holding system with shareholders including Foreign Exchange Reserve, China Investment Corporation, the Export-Import Bank of China, and China Development Bank. Seeking for reasonable returns took responsibility for investors and could have foundation for equitable cooperation and mutual benefit with market main bodies.

c. Investment and operation of Silk Road Fund insisted in principles of having complementary advantages and win-win cooperation with financial organizations home and abroad. It observed laws and regulations of China and invested countries, general market rules and international financial orders. It focused on green and sustainable development, respected domestic and international financial organizations, attached importance to cooperating with these organizations, and offered more choices by giving diversified investment methods for enterprises and projects. In the process of advancing healthy and stable global economy, Silk Road Fund had win-win partnership with other financial organizations.

d. Investment and operation of Silk Road Fund insisted in principles of open cooperation. As an open and inclusive organization, we welcomed investors home and abroad to participate in project cooperation. After a period of operation, the fund would open to more investors or cooperate on sub-funds. It would seek for cooperation chances with open attitude with no matter bilateral organizations or various industrial investment organizations. It would make contribution to regional and global development and prosperity.

Thirdly, I would like to introduce investment orientations of Silk Road Fund.

In line with the idea of mutual discussion, mutual construction, and mutual benefit, Silk Road Fund mainly supported investment and cooperation with countries and regions along the Belt and the Road. Except for these countries, there was no strict limit geographically. If other countries and regions met the requirement of our investment, we wouldconsider giving financial support. Silk Road Fund supported powerful Chinese companies to have cooperation, paid attention to share experience of China’s industrialization and modernization and high technology as well as advantage productivity, and boosted mutual development and prosperity of related countries. In terms of industries, the fund currently emphasized public transportation infrastructure investment, public infrastructure investment, energy industry investment, productivity and technology cooperation investment, and financial industry investment. I would like to emphasize that the mining industry CHINA MINING 2015 paid attention to was the major field which Silk Road Fund though highly of.

Four, it was about functions of Silk Road Fund. It promoted international mining investment and cooperation under the premise of mutual benefit.

Guests and friends, Silk Road Fund was like a ship sailing in the ocean of One Belt and One Road, and it was like a bond engaging in promoting combination of capital and industry. The fund was a good partner, hoping to advance international mining investment and cooperation under the premise of mutual benefit.

Firstly, Silk Road Fund concentrated on exerting special functions of One Belt and One Road investment. It was a financial organization, founded for the Belt and Road construction and focusing on related projects. With short decision chain and high efficiency, it would conform to the development trend of mining industry and promote deep and diversified cooperation between Chinese enterprises and many countries.

Government officials, scholars, experts and colleagues, no matter you came from traditional mining countries or emerging mining areas, you were welcomed to know Silk Road Fund. We could explore investment projects and cooperation chances, advance the Belt and Road construction, and achieve mutual development.

Secondly, Silk Road Fund could function as investment leverage and increased credit. As a typical capital-intensive industry, mining industry required huge investment in prospecting, development, production, and processing. Trade and transaction amount of mining industry ranked in top place in international trade statistics. Silk Road Fund, as a professional investor with national background, had solid capital and high-level credit. It could provide capital support for companies and projects in mining development and merger. It increased corporate credit, advanced project maturity, achieved financial condition, and boosted project implementation. For mining companies’ restructured capital operation, it functioned as professional investors and reliable partners.

Thirdly, Silk Road Fund could stabilize periodic fluctuation and the market. International mining supply and demand mechanism and investment environment were closely related to economic situations of countries. Mining investment featured huge capital amount, long period, slow return, and hard turn. Periodic fluctuation of industrial development was the major systematic risk investors faced. Compared with general PE organizations, the fund attached more importance to medium and long term returns with longer investment term. So, it could stride over development cycle and had higher tolerance for short-term financial fluctuation. The fund could assist companies with impulse-type periodic ups and downs, achieving long-term and stable corporate development. It was a hard-won investor for mining industry.

Fourthly, Silk Road Fund could function as flexible investment tools. Production and investment of mining industry generally accompanied with complex trade structures. Plans of investment mode were of great importance to projects. The fund, taking equity investment as major measure, could offer loans, debts, sandwich investment, sub-funds and many other products. It was very much in the minority of investment organizations which could operate all types of tools. It could coordinate the demand of mining companies and projects. It could build the most reasonable cooperation structure and realize profit maximization.

Fifthly, Silk Road Fund could improve efficiency and add value. In practice, some countries and international organizations would promote development and utilization of mining resources with capital investment. The fund, on the basis of adjusting to development plans, adhered to market operation. Its professional investment team had the capability to participate in mining cooperation as high-credit investors and high-level financial advisors. It helped companies to grasp development directions, find market signals effectively, improve corporative management, optimize financial plans, promote the combination of macro corporative development with micro market efficiency, and achieve long-term value increase.

Sixthly, Silk Road Fund could lead capital and industry. Mining industry as the most fundamental resource element had long industrial chain and various upstream and downstream industries. The fund could rely on its advantages, exert demonstration functions, lead and catalyze the entry of social and international capital to mining industry in the construction of Belt and Road. It could help related companies to extend along the chain, find potential and valuable investment chances, and realize addition effect.

Ladies and gentlemen, guests, friends, the theme of CHINA MINING 2015 was New Normal, New Opportunity, New Development. In the coming period, we should continually adjust to the new normal of economic growth, overcome the pressure of downward economy, and search for new chances of industrial and financial combination. In the process of self development, it would usher new development of global mining investment and cooperation and contribute to economic development as well as social improvement.

Thank you!

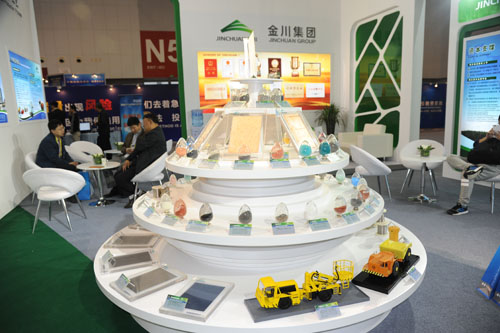

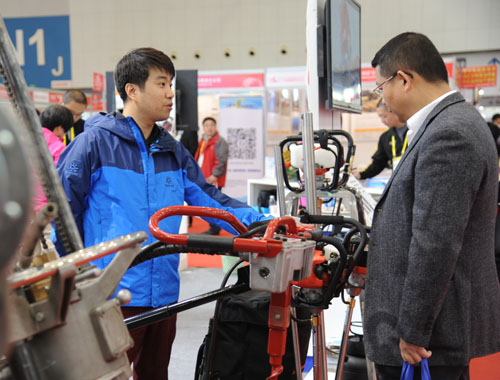

About CHINA MINING

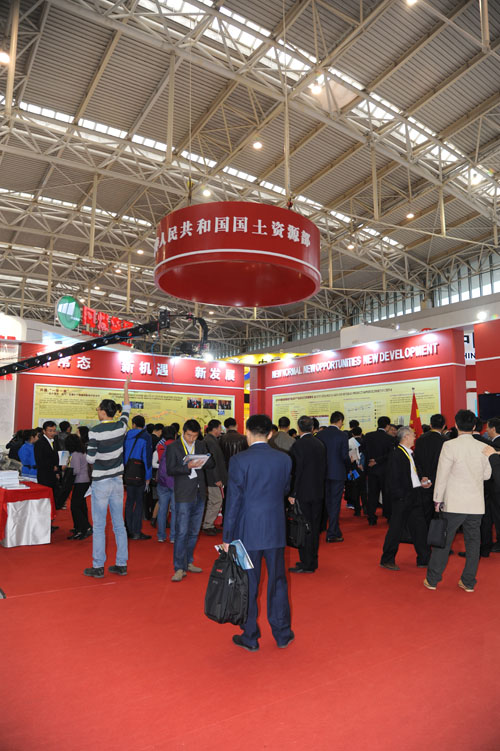

Since first held in 1999, the scope and influence of CHINA MINING has grown rapidly year by year. As a global mining summit forum and exhibition, CHINA MINING Congress and Expo has become one of the world’s top mining events, and one of the world’s largest mining exploration, development and trading platforms, covering all aspects of the whole mining industry chain, including geological survey, exploration and development, mining rights trading, mining investment and financing, smelting and processing, mining techniques and equipment, mining services, etc. playing an active promotion role in creating exchange opportunities and enhancing mutual cooperation between domestic and foreign mining enterprises.

CHINA MINING Congress and Expo 2015 will be held at Meijiang Convention and Exhibition Center in Tianjin on October 20th-23rd, 2015. We invite you to join the event and to celebrate the 17th anniversary of CHINA MINING with us. For more information about CHINA MINING 2015, please visit: www.chinaminingtj.org.