Professor Roderick G. Eggert delivered a speech in the Theme Forum of CHINA MINING 2012

Source: www.gtzyb.com Citation: www.gtzyb.com Date: Nov.4, 2012

(Photo from www.mlr.gov.cn. Photo:Ye Xingmao / Editor: Chen Hui)

The Theme Forum of CHINA MINING 2012 “Join hands to meet challenges and promote sustainable development” was held at Tianjin Meijiang Convention and Exhibition Center on the morning of Nov.4th, 2012. The photo reveals that Roderick G. Eggert, Professor and Director of the Division of Economics and Business, Colorado School of Mines, gived the speech in CHINA MINING congress and expo 2012.

Good morning, everyone.

First of all, congratulations on CHINA MINING and thank you for the invitation of the organizers. On behalf of our university,I wish to give you my warmest congratulations. I am very happy and very honored to attend this congress, and very happy to share my experience, share my opinions about the development of the mining industry in the world, I`d like to introduce my view for the metal price trend.

First of all, let’s look at the recent price trend. Before this, I would like to introduce some of the warning. The international monetary fund says the current world economic situation is even poorer than the imagination.

Rio Tinto has also said that we need to be careful in the short term. From 1980 to 2012, annual metal price index changed a lot, especially from 2009 to 2012. In the past 30 years, if compared with the price in the long term, look at the metal price movements in a long time (PPT), we can see that in the past 100 years, metal price changes, especially in the recent decades prices began to increase.

At the same time we also see that price rises in a high speed from 1970 to 2010. From 70 s and 80 s, and then to 90 years, change is more obvious, but all of these are not on behalf of the global economic situation, also cannot explain more things, until we must carry on the corresponding adjustment.

At the same time, we can see, in the economic development process, the metal price for economic influence is very big. In the whole price change process, we need to bring the effect of inflation factor take off. From 1900 to 2011, if the inflation factor carries on the corresponding adjustment, you can see how does the real metal price change. (PPT)we can see from 1900 to 2011 the change of each year. The price is falling, not just like that one which means a rising. In recent twenty years, change is different, the price is rising, it is from 2000 to 2010. Obviously, year after year fluctuations become very big, and from a long trend, you can see after 1971 it has significantly reduced, in addition to the past ten years.

Some observers think this is super cycle. That means in the past thirty years or forty years, it has been more than the real price index. From50s to 70 s, there is a stage of development. From 2000 to 2010, there is also a developing period. What about the future trend?

(PPT) We can see the current price index, we draw such a conclusion: first , from short to medium term, it is that needs promote the prices.

From one year to five years is short-term, medium-term is ten years’ change, we can see the long-term is ten years or more, the price change is from supply driving factors, so that price trend is a long price trend.

(PPT)We take a look at the price changes characteristic in long-term, short-term. Basically the change of demand for mineral resources is very clear with the macroeconomic change. That is to say the economy is expanding, the economy is growing, and at the same time the metal demand is increasing.

Of course we know that demand is actually in change every year, and changed a lot. We see that production capacity is fixed in the short term. If demand unexpectedly grows, because production capacity is fixed, the price will rise. In the past ten years, change is just like this. Needs promote the rise of the metal prices. In the short term, it must be so, because the market is to adjust, the price is sure to rise.

Let’s look at a slide (PPT), this is the basic explanation, we still have more explanation, that is to say, the level of economic activity and the economic structure, the two aspects are very important, usually in the strong economic growth, at the same time, it promotes the global GDP growth.

Now let’s look at this slide (PPT), from 1970 to 2011 , from 2012 to 2013 forecast growth, the two super cycle to price is very high, especially in the past ten years, or in the last five years , price grows quickly.

Under the growth of sustainable stable growth, when will be a sustainable stable growth? In the mid 80 s, it is relatively stable growth. After that, it is a big change. Especially in the past four years, change is very big, the global average is more than 4%, we see there are many times that four consecutive years of global economic growth will be more than above average.

What about the future? Every two years we have a economic outlook. From the left side of the chart right look, we can predict global growth of 2.3% in 2012. In 2013, it will be 3.6% growth. We need to explain that there are some risks; these downside risks are more dangerous than ascending risk. The lower growth, GDP growth will be up lower, ascending risk is higher. In the United States, government spending can be reduced under the United States government fiscal policy. By the end of the year, congress will issue a more reasonable resolution, so American GDP expectations will be more low. Second, downside risks I also read in the papers, with the government of relevant down, so that the outlook for economic outlook changes.

The third downside risk is the debt crisis, this is the third downside risks. So from the aspect of macroeconomic, there are many uncertainties, this is a situation for the one or two years.

In addition to economic activity level, economic activity structure is also very important. Because the spending of the economic activities for metal market is very important.

We see investment spending relatively focus on metal rather than consumption. What is the meaning? They will put the money into the metal which has a longer life cycle , such as building materials. Compared to the fan or refrigerator, we are more willing to put into the metal.

Assume that the global physical growth is 3% - 4%, we think that the growth of investment will have higher growth, higher than 3% - 4%. And in metal investment spending, it has a higher volatility relative to the overall economic development. Because the demand for purchasing precious metal products, such as building, automobile is relatively high.

(PPT)We`ll look at the expenditure structure. From this map you see the percentage the investment accounts for the GDP. From the situation in 1980, 1990 and 2010, we can see the status of China`s economic investment spending from 1/3 to 1/2 each are not identical, mainly because of the development of infrastructure, manufacturing, export, domestic demand of commodity production.

Globally, investment accounts for of global GDP percentage is a quarter, so you can see China is 1/3 to 1/2, and global is a quarter, this is also because of the situation of Chinese mining situation decision. this factor leads to China`s steel consumption and metal consumption. we can see that the steel, iron, aluminum, copper, nickel, zinc, 80 s China only accounts for 6% of the iron and steel. but in 2000, China accounts for 16% of the world, reaching 47% in 2010, we think in the future it will continue to improve.

Now the world is changing, China plays an important role. This is my first argument which is that need leads to the middle-term and short-term price change. Now copper price is relatively high, and it also makes the supplier rupture, and investors` behavior also affects the medium to short-term price. So if you want to know the metal market commodity prices, we must first understand the short-term to middle price changes.

The second argument is the cost and supply will drive long term price. Here I explain a bit more simple, and I want to get out of this map to explain (PPT). The price will eventually return to marginal cost. The vertical axis is the copper price per unit cost, green is on behalf of the cost. We can see the difference between 75% - 90%. Relatively it can explain some situation. We look at the marginal cost. In a certain period of time , actually we make all manufacturers get a profit, which encourages a lot of copper producers to modify so that price is back to the marginal cost range.

So if everyone wants to consider and understand the long-term metal price performance, we need to know and need to consider the cost of production in this period. After the high grade and high quality copper exhausts, people have to consider low grade, low quality of copper deposits, so it has relatively higher costs because of technological innovation.

My third argument is that the price can remain high in the trend for a long time. Sometimes the price is beyond trend. Sometimes the demand increases, we will have more investment, because the price is higher. But investment in the whole cycle has a time lag, or the time difference.

For investors, we are conscious about the demand changes after a period of time, especially in the investment and financing in the new capacity expansion. At the same time, receiving government approval also needs time. Demand will be relatively rapid change, but the production capacity and supply are relatively lagging. Change is slow, and it also need time. Sometimes the time will be ten years of time, so that the real manufacturer can adjust to change.

If the production capacity increases, excessive supply makes the market demand increasing. Because we do not know the future market changes, it will make the price drop, as in the 80 s and 90 s we see the copper price is in low condition.

And the concept, which price trend change , is called super cycle. we may cannot see chart data (PPT), I want to stress that recent studies show that they are using the data analysis, and the super cycle was analyzed. From this map (PPT), we can see from the bottom to the bottom of the valley bottom cycle, the peak to valley floor, 1865 to 1916 which appeared the peak. 1921 is the second interval, and the peak is in 1929, and from 1999 to now continues on, 2007 is the peak. We don’t know what about the future. According to the two research institutes analysis found that the result is also similar with the picture of the results .

The fourth argument is that each market is different, and each metal market price is different. Just mentioned in the first three arguments, we will be easy to understand metal price in a period of time. If you can understand the three opinions, and it will be easy to understand the change of metal prices.

You see this picture (PPT) is the price theory development theory. the black line, from the beginning of one hundred, is the first quarter of 2000. The black line from left to right is also the price index. At the beginning, we have looked at the price index and, later, we have different colors of the curve representing different metal prices. From 2000 to 2012, we see here not a single metal market and price index trend change exactly the same. We have three metal whose price index is higher. The most surprising curve and the most unusual market is iron ore market, including copper, zinc price index are higher than average price. Another price index interval, including nickel, zinc, aluminum prices are much lower. Aluminum did not enter the specific period, and it is basically balanced period.

Why is iron ore so special? In addition to the great demand for iron, there is also great demand for steel.

In addition to this, what element do they have? Perhaps it is the increasing demand which makes production growing, but don`t forget the time difference.

The generator, electric system and other electronic products need copper. Because of this, copper have relatively high growth. Demand grows make supply hysteresis. Capacity needs to constantly grow in order to catch up with the growth of the supply.

Aluminum is a very interesting metal market, because the growth of aluminum in the six metal is the highest, especially in the past 12 years. It grows fast than other metals, but the price is relatively lowest. Why does it have such a contrast? To some extent, supply cost of zinc is higher than the current aluminum manufacturing cost. In other words, if you predict the demand, it costs more than the highest cost, and this is why prices will be so smooth, even if the market for aluminum demand is so high.

So the characteristics of every metal market are not the same. (PPT) you can see various metal price correlation and price index in the long term. We have just see the line between the difference of price index. The red curve is the price index, and the black curve is copper, (PPT) you can see aluminum, compared with one hundred years ago ,is much higher than the price index. We all think aluminum is precious metal, and we don’t think so until we find the process making alumina into metal later. We think it is not considered precious metal. Now the price is more smooth .

Now let’s conclude. Needs determine short-term and medium-term price. From the point of long-term price, cost drive factors, cost leads to long-term price fluctuations. So now take a look at the future cost change, including some existing mineral deposits, the known mineral production cost, and future changes of mineral deposits and so on. In addition to technology innovation cause cost, all of these factors need to be comprehensively considered, so we can understand the long-term price changes.

So the first three point is very important, but we need to know more about the first four point, otherwise it is not complete.

The fourth point is that every metal market is not the same. We also talked about the gold, whose demand and supply is something entirely different. We are not talking about small metal markets, including rare earth, tungsten and GDP growth and macro economy. so this is another situation. Does this have the super cycle termination? I don`t like this concept, it is super cycle, but I hope you understand my four arguments. Super cycle and degree of each metal is different, we see two to three years ago, the emergence of a bubble is mainly because of supply, and then bubble burst, and then slowly catches up with the supply.

In the metal market, prices return to marginal cost. This phenomenon is also not strange, because in the past ten years, the price has been higher than the marginal cost. I think in a certain future period, the price will return to marginal cost, but we also cannot determine the specific time and specific price.

Thank you!

(translated by TLRHVC)

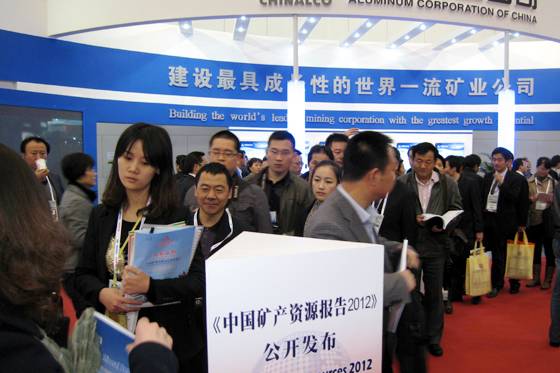

About CHINA MINING

Since first held in 1999, the scope and influence of CHINA MINING has grown rapidly year by year. As a global mining summit forum and exhibition, CHINA MINING Congress and Expo has become one of the world’s top mining events, and one of the world’s largest mining exploration, development and trading platforms, covering all aspects of the whole mining industry chain, including geological survey, exploration and development, mining rights trading, mining investment and financing, smelting and processing, mining techniques and equipment, mining services, etc. playing an active promotion role in creating exchange opportunities and enhancing mutual cooperation between domestic and foreign mining enterprises.

CHINA MINING Congress and Expo 2012 is held at Meijiang Convention and Exhibition Center in Tianjin on November 3rd-6th, 2012 (Expo is opened on 3rd pm Nov., 2012). We invite you to join the event and to celebrate the 14th anniversary of CHINA MINING with us. For more information about CHINA MINING 2012, please visit: www.chinaminingtj.org.