An overview of shale gas exploration through CHINA MINING 2015

As a new star in energy market, the shale gas is motivating an energy revolution in China.

The news came from the CHINA MINING Congress and Expo 2015 in Tianjin that exploration and development of shale gas in China has been carried out and breakthroughs have been made successively in marine facies of Sichuan Basin and continental facies of Ordos Basin. China comes into the third one achieving commercial development on shale gas after America and Canada.

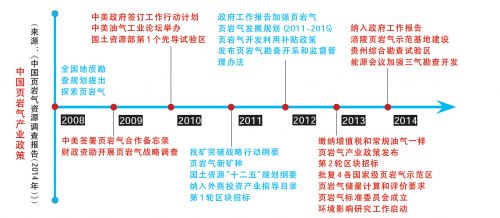

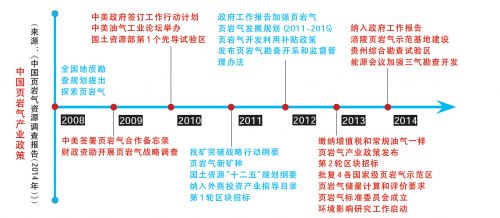

As the America was succeeded in fracturing the first shale gas well in 1981 and made a breakthrough in exploration and development of shale gas, the global pattern in energy and resources has gradually been broken. Up to 21st century, shale gas has brought major changes in the energy industry in many countries. Compared with the United States, China is merely a “new recruit” in shale gas development.

China is rich in organic shale beds with an extensive distribution and possesses a great potential in shale gas resources. After nearly 10-year practice of exploration and development, technological progresses and theoretic explorations, China has made significant progresses in shale gas development including resources potential evaluation, core technology and equipment system and basic theory construction, which basically meets the requirement for large-scale commercial development. During this session, Mr. Zhai Gangyi, Deputy Director of Oil and Gas Survey under China Geological Survey, introduced current situation of exploration and development of shale gas in China, theory innovation and technology advancement and future outlook in shale gas development and utilization. This page focuses on the latest news from CHINA MINING 2015.

■Current Situation of Exploration and Development

Four Shale Gas Production Areas Initially Formed

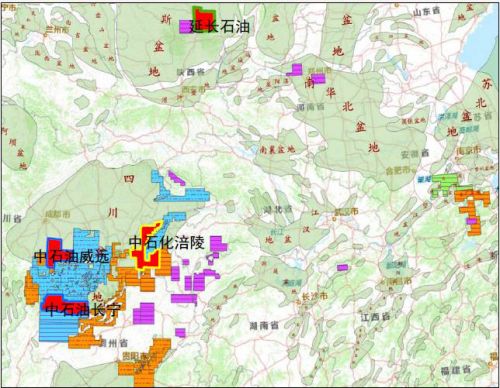

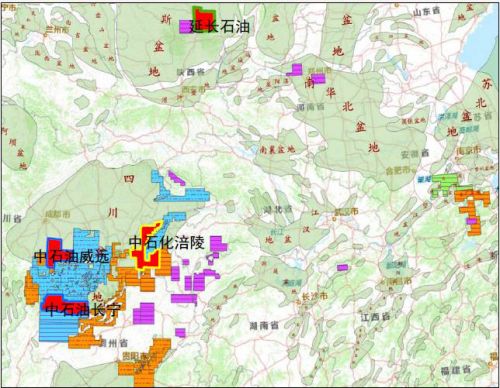

According to Zhai Gangyi, the proved reserves of shale gas in China have experienced a rapid growth in recent years with over 500 billion cubic meters currently. Four shale gas production areas including Fuling, Changning, Weiyuan and Yanchang are formed with an annual output capacity of over 6 billion cubic meters.

Among which, the SINOPEC explored the proven reserve of shale gas field with 380.598 billion cubic meters in Fuling and the CNPC totally submit the proved reserve of 163.53 billion cubic meters with Ning201—YS 108 well area in Shangluo of Changning shale gas field and Wei 202 well area in Weiyuan shale gas field.

The distribution map of four shale gas production areas

Fuling shale gas field of SINOPEC:

By the end of August, 2015, there were 253 wells being drilling, 204 wells being drilled and 143 being fractured into production. Every single well has a daily average production of 327.2 thousand cubic meters with top production of 591 thousand cubic meters. A total daily production reaches more than 12 million cubic meters and a total of gas production adds up to 2.5 billion cubic meters. The annual production capacity has already achieved 5 billion cubic meters.

Changning and Weiyuan shale gas field of CNPC:

◆Changning201-YS108 well area: there are 67 wells being drilled, 61 wells being drilling with an average testing daily production of 143 thousand cubic meters.

◆Weiyuan202 well area: there are 25 wells being drilled, 14 wells being drilling with an average testing daily production of 167.3 thousand cubic meters.

Shale gas production area in Ordos Basin of Yanchang Petroleum Corporation:

Yanchang Petroleum Corporation made a breakthrough in shale gas exploration in Ordos Basin. A number of wells including Liuping177 and Yunye2 achieved shale gas flow, presenting a promising prospect of exploration and development. Up to now, there are 59 shale gas well being drilled with 50 vertical wells, 3 cluster wells and 6 horizontal wells.

Significant discoveries in new beds and new areas:

◆Important Discoveries in Cambrian Niutitang FormationShale in the South

Shale gas was discovered in Weiyuan of Sichuan Province, Chengkou of Chongqing Municipality, Cengong of Guizhou Province and Yichang of Hubei Province.

JinyeHF-1 well: shale gas flow with high production was firstly achieved in lower Cambrian Qiongzhusi Formation in Weiyuan area in Southwest Sichuan, with a daily production of 80 thousand cubic meters after fracturing.

Yidi2 well: a well blowout occurred with combustible gas when drilling Tianheban Formation in Yichang of Hubei Province.

◆An important discovery in Sinian Doushantuo Formationshale in the South

Zidi1 well: shale with a thickness of 100 meters was discovered in Zigui County of Hubei Province, and the Doushantuo Formation shale features with a thickness of 145 meters and the gas-bearing volume of 2-4 cubic meters per ton, which were succeeded in ignition.

◆Important discoveries in Carboniferous- Permian shale in the North

Weican1 well is the first oil and gas parameter well inUpper Paleozoic Erathem deployed and conducted in western Taikang uplift area by Oil and Gas Research Center, with 69 layers through gas logging, 465 meters drilling thickness of shale and gas content of 4.5 m3/t.

Mouye1 well is the first shale gas exploration well in Zhongmou area, with 10 shale reservoirs, 277.6 meters thick and a daily testing gas production of 3000 m3/d after fracturing.

◆Important discoveries of Permian shale in the South

Baye1 well: separated gas content averagely reaches 1-2 m3/t, capable of ignition.

Hedi1 well: pure separated gas content reaches the peak of 3.03 m3/t

Jingye1 well: total hydrocarbon in target layer reaches 0.0238%-13.7639%

◆Important achievement in shale gas resources survey in Southern areas of Yunnan, Guizhou and Guangxi

Steady progresses have been made in bidding-won area exploration:

The bidding-invited area has successively conducted shale gas well drilling in Longmaxi Formation, Niutitang Formation and Carboniferous- Permian system in North China and achieved good discovery of shale gas.

■ Exploration and Development Situation

Breakthroughs only Made in Parts

Resources possess a great potential while the distribution regularities are not clear.

Ministry of Land and Resources organized and conducted shale resources potential evaluation in 41 basins in 2011, with 25 trillion cubic meters recoverable resources, and selected 180 shale gas favorable areas but the distribution regularities are still not clear.

Breakthroughs have been made in merely some areas and several layers, and scope has not yet been expanded.

At present, breakthroughs in shale gas exploration have been made merely in some areas and several layers. For example, Longmaxi Formation has only made breakthroughs in local part of Sichuan Basin and Niutitang Formation has only achieved the shale gas flow in a few exploratory well. In addition, it is still not clear currently in the development potential and prospect in continental facies and marine-continental transitional facies.

Fracturing site of Fuling shale gas field of Jiaoye9-1HF and 9-3HF

Optimal Longmaxi Formation in Sichuan Basin and its lower periphery

The high-quality shale in Sichuan Basin and its peripheral lower Silurian Longmaxi Formation features with extensive distribution, great thickness, well gas-bearing capacity, great resources potential with20% of national shale gas resources, promising exploration and development and key advantage of preservation condition.

Important Lower Cambrian Niutitang Formation (with Sinian Doushantuo formation) in the South

Niutitang Formation shale features with extensive distribution, great thickness, high maturity, a certain gas-bearing capacity but a high degree of thermal evolution, great tectonic destruction and relatively great difficulty in exploration. The working idea of “finding low in high and weak in strong” has taken initial shape.

Favorable conditions for forming shale gas in Upper Paleozoic marine facies in Yunnan, Guizhou and Guangxi

Another breakthrough is expected to be made in this area.

The localization is basically achieved in technology and equipment but the core technology requires continuous efforts to make a breakthrough.

China currently is capable of drilling the horizontal well with less 3500 meters and staged fracturing, explores and implements the industrialized-well operation model and independently innovates equipment including 3000HP fracturing truck. However, the complementary development technology for over 3500-meter wells, micro-seismic monitoring technology and dynamic production forecasting technology are failed to master and equipment including rotary geo-steering system, staged fracturing with sliding sleeve, nano-microstructure and composition analysis are still out of localization.

The development cost is gradually decreasing but the single well cost continues to stay in a high level.

The economic development of shale gas still facies challenges and its commercial development still require sequal attention to supportive policy and cost reduction through technology.

■Progress in Geological Theory Research

Main controlling factors in shale gas of marine facies in South were found out

The complexity and uniqueness in geological conditions of shale gas in China decide that our shale gas exploration cannot mechanically imitate the experience of shale gas exploration and development achieved in America. It is the key to resolve problems of shale gas exploration and development in China to strengthen theory researches on accumulation mechanism and distribution regularities and technological progresses in exploration and development.

According to Zhai Gangyi, China now has preliminarily concluded main controlling factors of enrichment and high-production of shale gas in marine facies in the South.

Deep shelf as favorable facies belt for developing high-quality shale

Deep shelf features with abundant planktonanda strongly reducing sedimentary environment, conducive to the accumulation and preservation of organic matters and the development of organic pore, high organic carbon content and thick high-quality shale with regular distribution.

Tectonic preservation condition as the key factor of shale gas accumulation

The high-quality shale in deep shelf of marine facies in the South generally experiences two stages including early continuous deep burial and late continuous uplift. Roof and floor conditions are main factors of shale gas retention and preservation in early continuous deep burial stage, and the tectonism is the main factor of shale gas preservation in late continuous uplift stage.

The relatively steady tectonic area and favorable roof and floor conditions play a vital role in shale gas with high production. Formation pressure coefficient serves as the direct evaluation index to preservation condition of shale gas.

Reservoir physical property as important condition for shale gas with high production

Shale gas reservoir with natural fractures development, high porosity, high gas content and low ground stress difference greatly contributes to shale gas with high production. The better micro-fracture developed, the larger proportion of free gas and higher initial production will be. And the less horizontal stress difference, the better fracturing will gain.

Process technology as guarantee for shale gas with high production

Horizontal well trajectory and staged fracturing technology are crucial factors effecting the production after fracturing.

Seven main controlling factors

◆High-quality shale sector in abyssal shelf facies features with great thickness and steady distribution.

◆ Relatively steady tectonism, favorable preservation condition and moderate burial.

◆ Formation overpressure (pressure coefficient>1.2)

◆Reticular natural fractures development

◆High porosity and gas content

◆Less difference in ground stress

◆Horizontal well trajectory is perpendicular to maximum principal stress.

■Progress in Exploration and Development Technology

Independent Innovation to Step Up Development

Shale gas resources in China features with complicated types and various distribution formations, and relatively great differences in main controlling factors of shale gas accumulation with various sedimentary types and different tectonic units, which are great challenges faced by China in shale gas exploration and exploitation. However, independent innovation on exploration and development technology has speeded up the development of shale gas resources in China.

Shale reservoir well-logging evaluation technology

Compared with conventional reservoir, the well-logging evaluation of shale gas reservoir presents more complicated. The logging information plays an essential role in key evaluation parameters including the source rock evaluation, shale gas qualitative identification, the acquisition of total organic carbon, gas content and rock brittleness index. The comprehensive well-logging evaluation has come into the technological support to current shale gas exploration and development.

At present, China has built up the immediate recognition mode for well-logging information of shale gas reservoir in marine facies has been. The “four high and three low” well-logging response characteristic comprehensively reflects high TOC, fine reservoir property, high gas content and good potential in fracturing.

In addition, it also built up the TOC and gas content litho-density interpretation model and mineral content and porosity interpretation model based on elemental capture spectroscopy sonde and combined framing density.

Seismic prediction technology forshale gas “sweet point”

◆Wave-impedance inversion technology for shale thickness predication

◆ TOC pre-stack seismic quantitative predication technology

◆ Pre-stack inversion and gas recognition technology

◆ Seismic fracture prediction technology

Achieving the prediction of sweet point area through seismic and electrofacies characterization.

Shale gas horizontal well drilling and completion technology

◆ Horizontal well drilling and design optimization technology

◆ Horizontal well optimized and fast drilling technology

◆ Remote transmission geo-steering drilling technology

◆ “Well factory” effective drilling mode for complex mountain surface

Staged fractured gas testing technology of shale gas horizontal well

◆ Parameter optimization technology of differentiation staged fracturing

◆ Pumping bridge plug and perforating combining operation technology, horizontal well coiled-tubing drilling plug technology

◆Effective fracturing fluid system for geological features in China through independent innovation

◆ Micro-seismic monitoring technology

◆ Fracturing flow back treatment technology

◆ Compound bridge plug and 3000HP fracturing truck through independent innovation

◆ Forming the “well factory” fracturing operation mode

Jiaoye42 platform: 17 days for 4 wells with 75 sectors fractured, the top of 8 sectors fractured in a single day, the highest fluid volume of 14 thousand cubic meters into the well and the highest fractured sand volume of 508 cubic meters in a single day, which achieved the construction record with top fractured sectors in single day, top added sand volume and fluid volume.

◆Attempt to “carbon dioxide” waterless fracturing

■ Development Outlook

Face Both Opportunities and Challenges

1. Breakthroughs in Sichuan Basin and its periphery

CNPC and SINOPEC made constant efforts to advance the exploration in peripheral Sichuan Basin and successively achieved progresses and breakthroughs in areas including Dingshan, Nantianhu, Wuzhishan of Meigu County, Micangshan, peripheral Changning and Xuanhan-Wuxi.

2. Increasing shale gas productivity construction

CNPC, SINOPEC and Yanchang Petroleum Corporation increasingly strengthen the shale gas productivity construction and it is expected that the already production capacity in 2017 can exceed 15 billion cubic meters.

3. Progresses expected in bidding won areas exploration

Progressive discovery of shale gas by means of exploration and drilling and fracturing transformation are gained in areas of Baojing, Qianjiang, Cengong, Laifeng, Chengkou and Zhongmou.

Next, horizontal well drilling and staged fracturing will be in practice and it is expected to achieve progresses in industrial gas flow.

4. Ministry of Land and Resource further strengthen efforts to survey on shale gas resources

5. Active initiation on national key science and technology special projects on unconventional oil and gas exploration and development

6. Green and environment-friendly development

◆Establishing green development complementary technology

◆Developing environmental protection measures

The shale gas development in China insists on placing safety and environmental protection, green and low-carbon as top priority, and paying equal attention to resource development and ecological protection, strictly follows safety and environment assessment procedures and strengthens HSE system construction and total HSE management to promote the shale gas field development with safety, effectiveness and cleanness.

◆Forming environmental regulation and contingency plan(Translated by TLRHVC)

About CHINA MINING

Since first held in 1999, the scope and influence of CHINA MINING has grown rapidly year by year. As a global mining summit forum and exhibition, CHINA MINING Congress and Expo has become one of the world’s top mining events, and one of the world’s largest mining exploration, development and trading platforms, covering all aspects of the whole mining industry chain, including geological survey, exploration and development, mining rights trading, mining investment and financing, smelting and processing, mining techniques and equipment, mining services, etc. playing an active promotion role in creating exchange opportunities and enhancing mutual cooperation between domestic and foreign mining enterprises. For more information about CHINA MINING, please visit: www.chinaminingtj.org.